When something is threatening us, experience tells us to get away as quickly as possible. That’s a prudent reaction when dealing with bears, avalanches and hurricanes, but it’s not so helpful when it comes to investing.

Markets bounce back

When markets drop, our first instinct may be to sell immediately. But that’s often the worst thing to do.

In fact, by the time we’re feeling that urge to sell, it’s probably already too late to limit the damage. And the period right after a market drop is often the most profitable. This is when portfolio managers typically buy more of the stocks they believe in, because those stocks are now bargains.

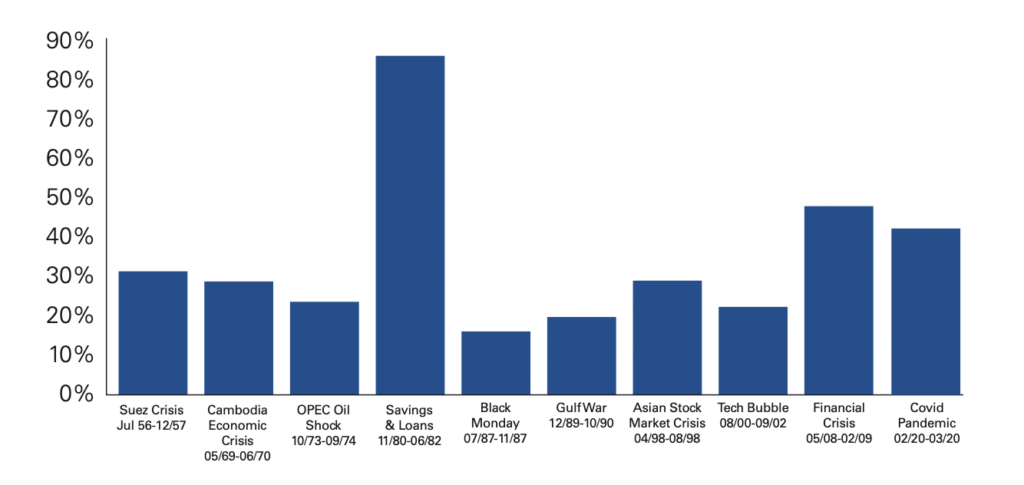

And when the market recovers, it’s often in vigorous fashion, as the chart below shows.

A year after a crisis, markets have been back up an average of 33%

S&P/TSX Composite Index total return 12 months after markets hit bottom

Source: Bloomberg, as at December 31, 2021.

By selling when your investments are dropping, you’re locking in a loss and missing the possible run up to pre-decline or higher prices.

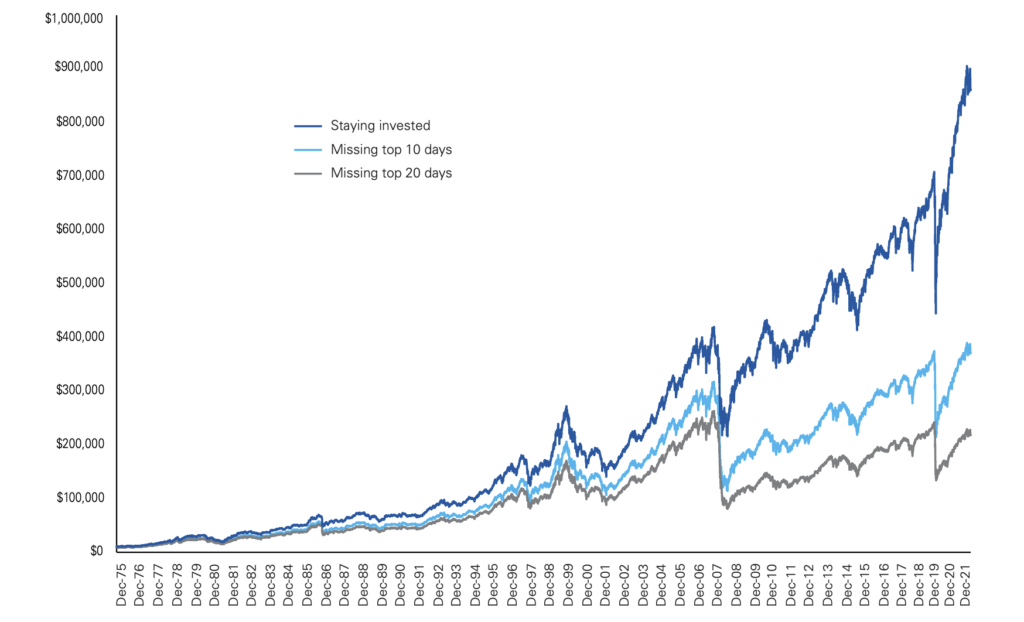

Selling in and out of the market based on fears and optimism will likely mean you’ll be sitting on the sidelines on some of the best days. The chart below illustrates the potential effect.

Cost of missing the best 10 days on the Toronto Stock Market

S&P/TSX Composite Index CAD - growth of $10,000

Source: Bloomberg, as at December 31, 2021. This chart is a hypothetical illustration and should not be relied upon for any other purpose.

A better strategy may be to stay invested and focus on the long term, rather than react to the ups and downs of the market. This is where having a financial advisor can be helpful.

Speak with your advisor about how your investment portfolio fits with your risk tolerance, how it would likely be affected by a major market correction, and if there are protections built in.

The information provided herein does not constitute financial, tax or legal advice. Always consult with a qualified advisor prior to making any investment decision. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The iA Clarington Funds are managed by iA Clarington Investments Inc. iA Clarington and the iA Clarington logo, and iA Wealth and the iA Wealth logo, are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license.

You might also be interested in: