Periods of market volatility have peppered the past century. They’re not new. And they will happen again.

As many investors already know, these ups and downs can wreak havoc on our portfolios and emotions. However, history has shown that in times of turmoil, sticking to a disciplined strategy can pay off. Here’s a new perspective and strategies needed to sail through market turbulence – and find opportunity in volatility.

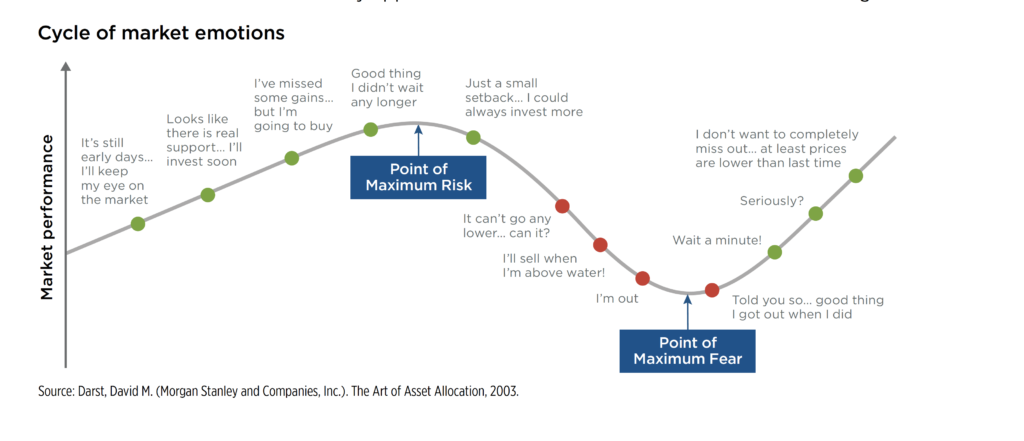

Avoid letting your emotions guide your investing. Emotional investing is easy to fall into, but it can wreak havoc on any portfolio. Often, the best and worst times to invest are the very opposite of what our emotions tell us we should be doing.

See this cycle of market emotions:

When markets drop, our first reaction may be to consider selling immediately. When faced with a bear, our first instinct is to run, right? But that’s often the worst thing to do. We talk more about this concept in this video with Aleks Sui from Invesco.

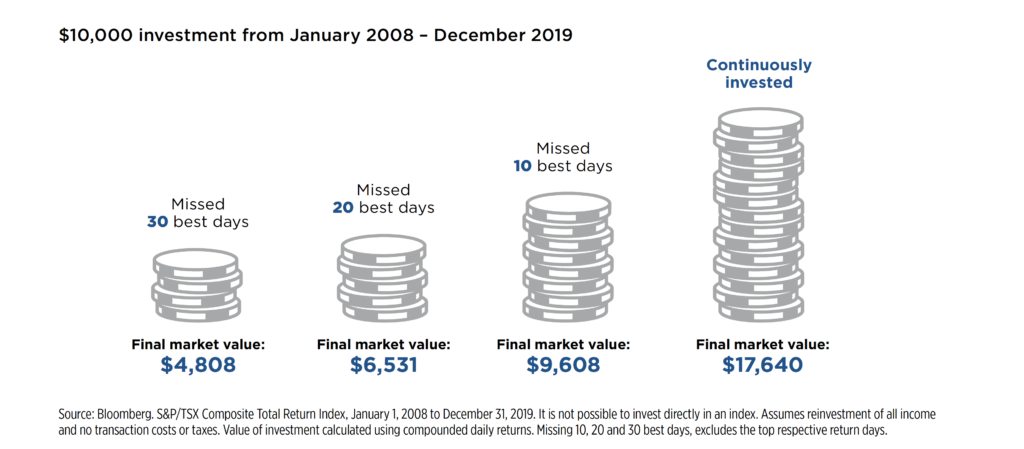

Historically, investors have had many reasons to worry about market volatility. Despite the short-term reasons for not investing, maintaining a long-term perspective can work to our advantage; over time, markets recover and grow.

Trying to time the ups and downs of the market can leave money sitting on the sidelines when it should be invested. This image shows the impact of missing the best 10, 20 and 30 days on a $10,000 investment in Canadian stocks over the past 10 years. As you can see, staying invested could have led to a better outcome for investors.

In times of turmoil, sticking to certain strategies can pay off, like with diversification. Different asset classes and geographic regions perform differently through different market cycles. That’s why it’s important to avoid keeping your eggs in one basket, as the saying goes. By diversifying your portfolio, you can access the better performers while mitigating risk of being overly concentrated in those that lag.

By investing a fixed dollar amount at regular intervals over time, in certain market conditions, can result in a lower average price and a higher gain. We talk more about the market bounce back in this article about emotional investing. But staying the course in times of turmoil can produce opportunities for growth or “volatunity” as we said at the beginning.

If you have any questions, please reach out to us, we’d be happy to discuss your portfolio with you.

This information has been prepared by Andrew Raymer & Ryan Husk who are Senior Wealth Advisors for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Andrew Raymer & Ryan Husk can open accounts only in the provinces in which they are registered.