The single most important ingredient of your long-term financial success is working with Senior Wealth Advisors to help you grow & preserve wealth.

Whether you’re just beginning your financial journey or planning a legacy for generations to come, a Senior Wealth Advisor – one you can trust to develop a comprehensive wealth plan – can help you reach your destination with peace of mind.

We think so. Planning, unbiased advice, working together, transparency, and fully licensed senior wealth advisors with a full suite of investment and financial products to use to build robust and diverse portfolios.

Personal wealth planning, supported by unbiased advice is key to helping you achieve your goals. Here’s what we can review together:

A proven wealth management philosophy is one that takes the emotion out of the equation and relies on a disciplined, long-term approach. Your objectives, risk tolerance, return expectations and time horizon are key factors in helping to design a plan that can meet your retirement and other goals.

This isn’t just about contributing to your RRSP or group pension plan. It’s also about how you’ll live in this next stage of your life. Focus on creating a plan that helps you achieve your overall goals in retirement.

Using sound investment strategies, we can help reduce the amount you pay in tax every year.

An attractive benefits plan can help you recruit and retain top employees. Our customized solutions help to create a unique benefits and retirement plan that draws from a wide range of insurers from across Canada

Whether you’re looking to fund a child’s education or returning to school to upgrade your credential, we can help you understand your options and maximize the value of a Registered Education Savings Plan (RESP).

We take an integrated approach when assessing your needs to develop a risk management plan that addresses all aspects of your life – and all scenarios that could affect your financial well-being.

To plan for the preservation and transfer of your assets, we’ll help keep an eye on the horizon by understanding your situation and wishes, including tax-efficient legacy planning.

The Registered Disability Savings Plan (RDSP) is available to provide assistance to families. A Senior Wealth Advisor has considerable experience developing effective plans to provide for those with special needs.

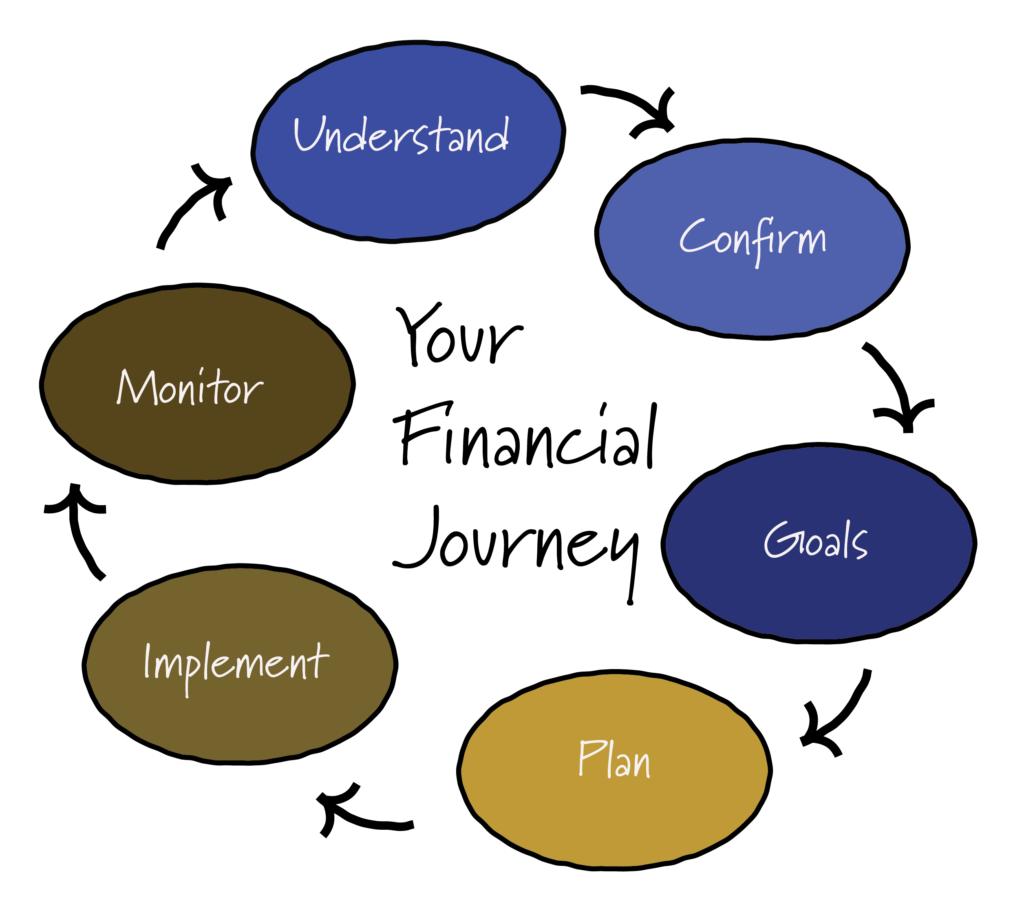

1. Meet to understand what is truly important to you

2. Confirm your needs and priorities

3. Set your short- and long-term goals

4. Develop your personal, holistic wealth plan

5. Implement your plan and drive it forward

6. Monitor your plan’s progress against goals

The process repeats annually

We offer a full suite of products and services for individual investors, families and business owners.

Retirement

Tax

Trust & Estate

Business

Succession

Mutual Funds

Equity & fixed-income securities

Exchange-traded funds (ETFs)

Alternative investments

Retirement

Education savings

Non-registered

Tax-free savings

Disability savings

Group RRSP

Universal, term & whole life

Disability income protection

Critical Illness

Long-term care

Life & insured annuities

Group benefit plans

*Insurance products are provided through PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund.

Crafting a holistic, personalized wealth plan begins with understanding your unique needs and the life you envision for yourself and your family. That’s why we place so much emphasis on meeting with you – so we can listen to you and your family as you paint a picture of the future you’re striving for. Then, using our full range of financial solutions, we work to find balance, growth, and longevity for your portfolio.

Meetings can take place in person at our Stratford or Tavistock office or online.

Andrew Raymer holds a Bachelor of Business Administration from Brock University, is a Certified Financial Planner®and a Chartered Investment Manager®.

Ryan Husk holds a Bachelor of Business Administration from Brock University, is a Responsible Investment Specialist, holds a Canadian Securities License, and a Life Insurance License.

This article is a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.