Market volatility and major downturns may cause investors to rethink their investment approach, including moving to cash. Historically, a better approach has been to follow the lessons of the most successful investors: staying the course during a downturn – even adding to positions when the situation seems to be at its very worst – and then sitting tight for what history tells us will be the inevitable recovery.

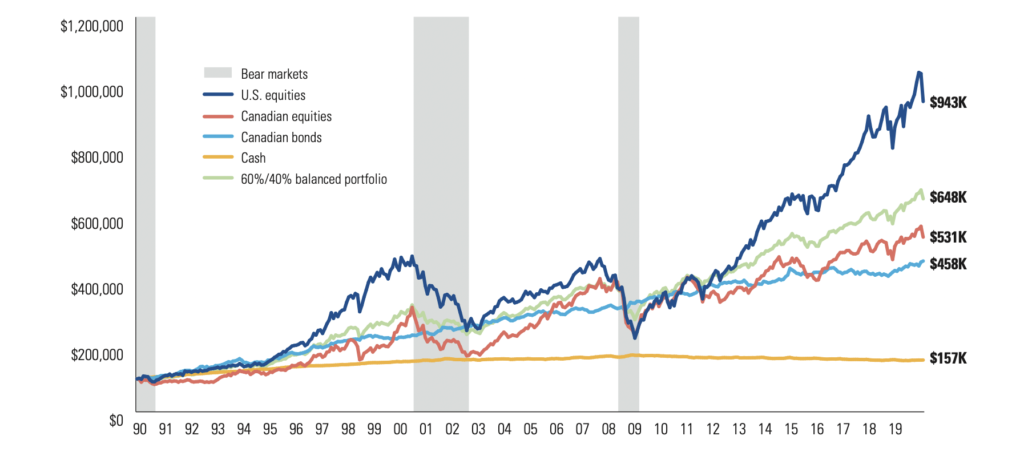

As the chart below shows, whether it’s stocks, bonds, or a mix of the two, time and time again bear markets have been followed by recoveries that exceed previous highs, while cash has only provided minimal opportunity for growth.

Growth of 100,000 over the last 30 years

(inflation adjusted)

Source: Morningstar Direct, as at February 29, 2020. Returns are adjusted for inflation monthly using the Consumer Price Index (CPI) for Canada. U.S. equities represented by S&P 500 TR USD; Canadian equities represented by S&P/TSX Composite TR; Canadian bonds represented by FTSE Canada Universe Bond; 60%/40% balanced portfolio represented by 30% S&P 500 TR, 30% S&P/TSX Composite TR, 40% FTSE Canada Universe Bond; cash represented by FTSE TMX 91 Day T-bill.

You might also be interested in:

Nothing in this document should be considered as investment advice. Always consult with your investment advisor prior to making an investment decision. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The iA Clarington Funds are managed by iA Clarington Investments Inc. iA Clarington and iA Clarington logo, and iA Wealth and iA Wealth logo, are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license.