Severe market declines are unnerving, and understandably cause many investors to reevaluate their options.

Stay put? Cut and run? Add more to my portfolio to benefit from a rebound?

While no single solution is right for every investor, the historical data can provide some insight into which options have the most attractive potential outcomes.

Case study: 2008 financial crisis

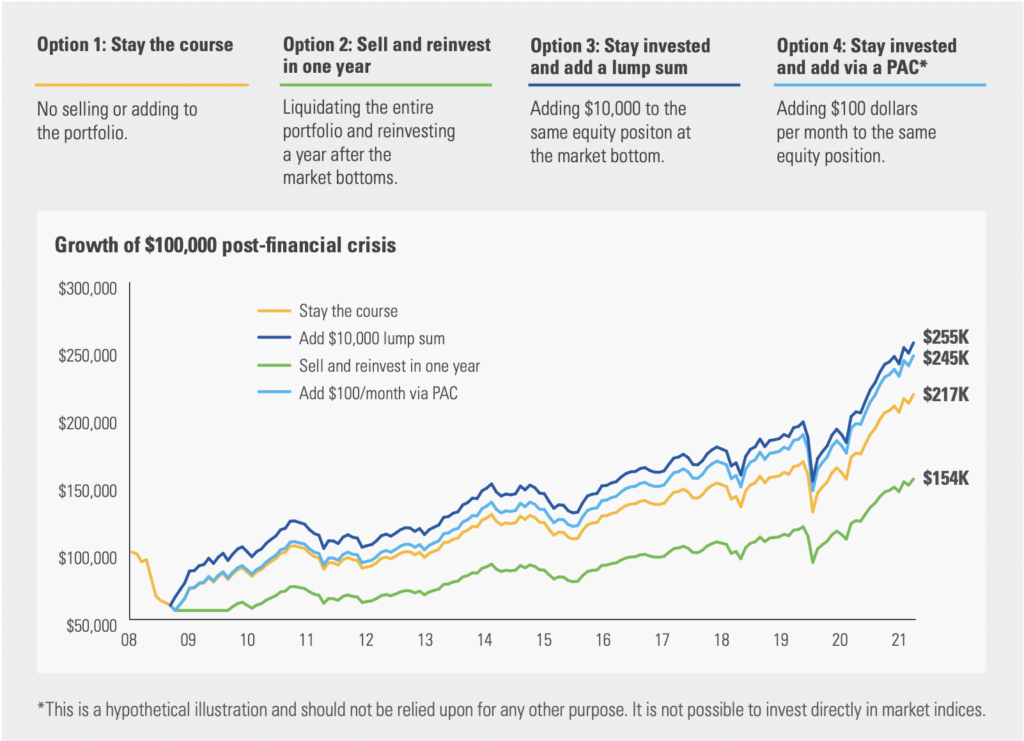

The chart and table below track the hypothetical results of four typical investor responses to the financial crisis of 2008. For an apples-to-apples comparison, we make the starting assumption in each case of a $100,000 investment in Canadian equities right before the market dropped.

Investment option

original investment

Add $10,000 lump sum**

18

Add $100/month via PAC*

23

Stay the course

25

Sell and reinvest one year later***

105

Source: Morningstar Direct. S&P/TSX Composite Index monthly data from May 1, 2008 to December 31, 2021 *PAC is a pre-authorized contribution plan. **Assumes an investment of $100,000 made on February 28, 2009. ***Assumes reinvestment on February 28, 2010.

When markets tumble, the first instinct many have is to run for the exits with the intention of reinvesting when things stabilize. But the data shows this may not be the best decision – assuming the goal is to recoup losses as quickly as possible. For investors who sold off their positions in 2008 and waited a year to get back in, it took over 105 months to recoup their original invested amount. The reason is simple: they missed out on some significant gains while they were on the sidelines.

The best approach to the 2008 financial crisis was to add to the portfolio when things seemed to be at their worst. And while not the optimal approach from a return perspective, staying the course was still a very solid choice as well.

Speak with your advisor to help decide which response to a market downturn is right for your unique circumstances and needs.

Nothing in this document should be considered as investment advice. Always consult with your investment advisor prior to making an investment decision. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The iA Clarington Funds are managed by iA Clarington Investments Inc. iA Clarington and iA Clarington logo, and iA Wealth and iA Wealth logo, are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license.

You might also be interested in: